Career and Financial Management Course

In Career & Financial Management, students will:

- Investigate career pathways and decision-making strategies

- Learn about budgeting, saving, loans, credit, and investing

- Identify career readiness skills and educational opportunities for advancement

Career and Financial Management Course for the High School CTE Classroom

Prepare students to learn about a wide selection of career options and make important decisions that will pave the way for positive employment opportunities and strong financial futures.

Student-Centered Design

Based on decades of educational research, each course is designed to maximize student learning, motivation, and achievement. Utilize pedagogical concepts such as Understanding by Design, Growth Mindset, and Video and Project-based Learning.

Interactive Learning

Engage students every step of the way with relevant content, interactives, videos, discussion boards, text-to-speech, language translations, projects, and more. It’s a learning experience students love.

Ready for the Real World

Students become career ready when they go beyond understanding concepts to applying them in real life. Through practical activities, students gain the skills they need for in-demand careers.

Equip students with career- and financial-planning skills

-

Course Outline

-

Module Introduction

-

Interactive Instructional Design

-

Formative and Summative Assessments

-

Accessibility

Career and Financial Management Course Outline by Module

-

- Module 1: Career Development and Options Beyond High School

- Module 2: Job Searching and Workplace Regulations

- Module 3: Career Readiness Skills and Lifelong Learning

- Module 4: Leadership, Ethics, Business Communications, and Technological Innovations

- Module 5: Budgeting and Money Management

- Module 6: Credit, Loans, and Interest

- Module 7: Investing, Consumer Options, and Protections

- Module 8: Insurance and Taxes

Module Introduction

-

Module Introduction Video and DescriptionEach module begins with an introductory video where the instructor sets the stage for topics and learning objectives for the upcoming module. The video is followed by a short description of the module content.

-

Module Learning ObjectivesEach module introduction includes the set of learning objectives for students to review prior to beginning instruction.

-

Polling QuestionStudents engage with an interactive poll related to the upcoming module content. After completing the poll, students can see how their peers responded with a percentage breakdown of the results.

-

Introduce New VocabularyThe module introduction concludes with an interactive vocabulary matching activity, designed to familiarize students with words and concepts they will learn in the upcoming module.

Interactive Instructional Design

-

Engaging Lesson VideosEach lesson begins with an instructional video from an expert educator, designed to grab students’ attention while addressing learning objectives.

-

Interactive ReadingEach lesson video is followed by an interactive reading where students dive into new material with embedded interactives like hot spots, flip cards, slides, videos, and more!

-

Integrated ActivitiesActivities are embedded purposefully between lessons and incorporate a variety of interactive tools for students to practice what they’ve learned.

-

Project-Based LearningEnd-of-module projects provide the opportunity for students to apply what they’ve learned to a real-world situation that they would encounter in the workforce.

Formative and Summative Assessments

-

Concept CheckEmbedded concept checks include a variety of low-stakes activities, including short answer responses, matching, flashcards, and sorting.

-

Discussion-based ReflectionsThought-provoking discussion prompts invite students to process and share their learning with their peers. Utilize your LMS discussion board or have students work in an individual course journal.

-

Short Answer AssignmentsShort answer assignments are included at the end of each module, providing an opportunity for students to analyze and apply their learning to a real-world situation. Students are supplied with a detailed assignment rubric, with clear expectations.

-

Module QuizzesEach module concludes with a quiz, assessing student understanding. Quizzes are auto-scored and the results report back to the teacher’s gradebook in their LMS.

-

Final ExamA comprehensive final exam assesses student skills and knowledge at the end of the course. The final exam is auto-scored and the results report back to the teacher’s gradebook in their LMS.

Accessibility

-

Text-to-SpeechAudio features allow greater accessibility for students. Highlight any text within the course to have it read out loud, including image alt text.

-

Language TranslationsTranslate any text within the course, including video transcripts, into 60+ languages. Additionally, many language translations can be read out loud using the text-to-speech feature.

-

Closed CaptioningAll videos within the course include closed captioning with the ability to access video transcripts and translate into 60+ languages.

-

Alternative ActivitiesAlternative activities are embedded throughout lessons to meet accessibility standards and provide alternatives to the interactive activities in multiple choice format.

Explore course content to promote learning

Course Preview

Get a sneak peek into the Financial Management course, featuring key learning highlights.

Digital Tour

Experience the engaging instructional design and learn about system integrations.

Flexible System Integrations for Your CTE Program

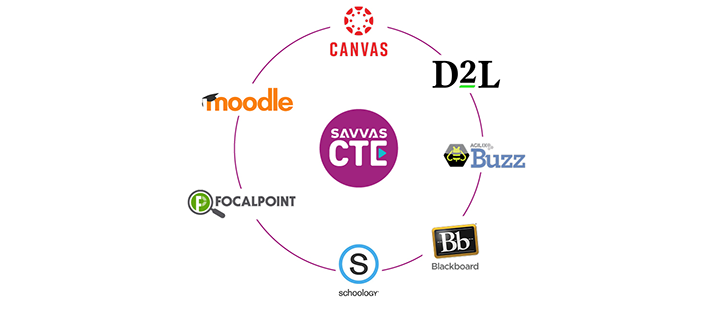

Seamless Integration With Your LMS

CTE has never been more accessible with digital courses that integrate smoothly with your Learning Management System. Course materials are available anytime, anywhere, all in your familiar and convenient LMS.

Additional Career and Financial Management Resources

-

Downloadable Instructors’ Guide

-

Course Syllabus

-

On-Demand Training

Downloadable Instructors’ Guide

Course Syllabus

The syllabus includes a high-level course overview, module overviews, and module learning objectives.

On-Demand Training

Frequently asked questions about Career and Financial Management

-

What modules are covered in this course?

- Module 1: Career Development and Options Beyond High School

- Module 2: Job Searching and Workplace Regulations

- Module 3: Career Readiness Skills and Lifelong Learning

- Module 4: Leadership, Ethics, Business Communications, and Technological Innovations

- Module 5: Budgeting and Money Management

- Module 6: Credit, Loans, and Interest

- Module 7: Investing, Consumer Options, and Protections

- Module 8: Insurance and Taxes

-

What grade levels is this text appropriate for?Grades 6–12

-

What types of programs is this course designed for?This program is designed for CTE Career and Financial Management pathways or elective offerings.

-

Is this program available in print or digitally?Career and Financial Management is a robust, digital–only course ideal for virtual or blended learning.

-

What teacher resources are available?Teacher resources include the course syllabus, instructors’ guide, and digital courseware access. Additionally, an on-demand, self-paced teacher training course covers the fundamentals of implementing the curriculum.

-

Which Learning Management System (LMS) does this course integrate with?Digital courseware is delivered by LTI integration with the following Learning Management Systems: Canvas®, Schoology®, Blackboard®, Moodle®, AGILIX® Buzz®, D2L or Focalpoint.

-

What are the digital license options?Student digital access to Career and Financial Management can be purchased for 1 year.

-

How long does it take to complete the course?Career and Financial Management is designed to support a full-credit course and therefore may be used to support a semester- or year-long option. On average, this course requires 80 instructional seat-time hours, equating to roughly 3–4 lessons per week. Teachers can make course customizations if desired to meet specific needs.

Prepare your students for college and career success. All with one solution.

Whether you want to empower your students to explore potential careers, prepare for college, or become certified professionals, it’s easy to do it all with Savvas PathMaker. Simply mix and match dual enrollment courses and CTE courses from our comprehensive catalog to create personalized pathways for every student.

Mix and match to build your perfect career pathways:

| Example Pathway | What students learn | What students earn |

|---|---|---|

| IT Associate | Networking† Cybersecurity 1† Professional Communication * |

Cisco Certified Network Associate |

| Aerospace Technology | Aeronautics and Space Travel † Drones: Remote Pilot † |

FAA Part 107 Commercial Drone Pilot 3 college credits |

| Digital Marketing | Meta® Social Media * Adobe InDesign® † Professional Communication * |

Meta® Certified Digital Marketing Associate Adobe® Certified Professional in Print & Digital Media Publication using Adobe InDesign® 3 college credits |

* Outlier by Savvas Dual Enrollment